#MadeInTheSouth

Last week, Stoecklin Logistics had the pleasure of being part of the Southern Automotive Conference (SAC) in Birmingham, AL. The SAC hosts top-level content and discussion, introducing and exploring the latest innovations and issues related to automotive manufacturing. It brings together key industries including manufacturing, safety, logistics, government, and energy as they relate to automotive manufacturing.

The SAC is in its 14th year of gathering together automotive manufacturers, suppliers, and service providers from all over the world, with a special focus on those based in Alabama, Georgia, Kentucky, Mississippi, South Carolina, Tennessee, and Texas.

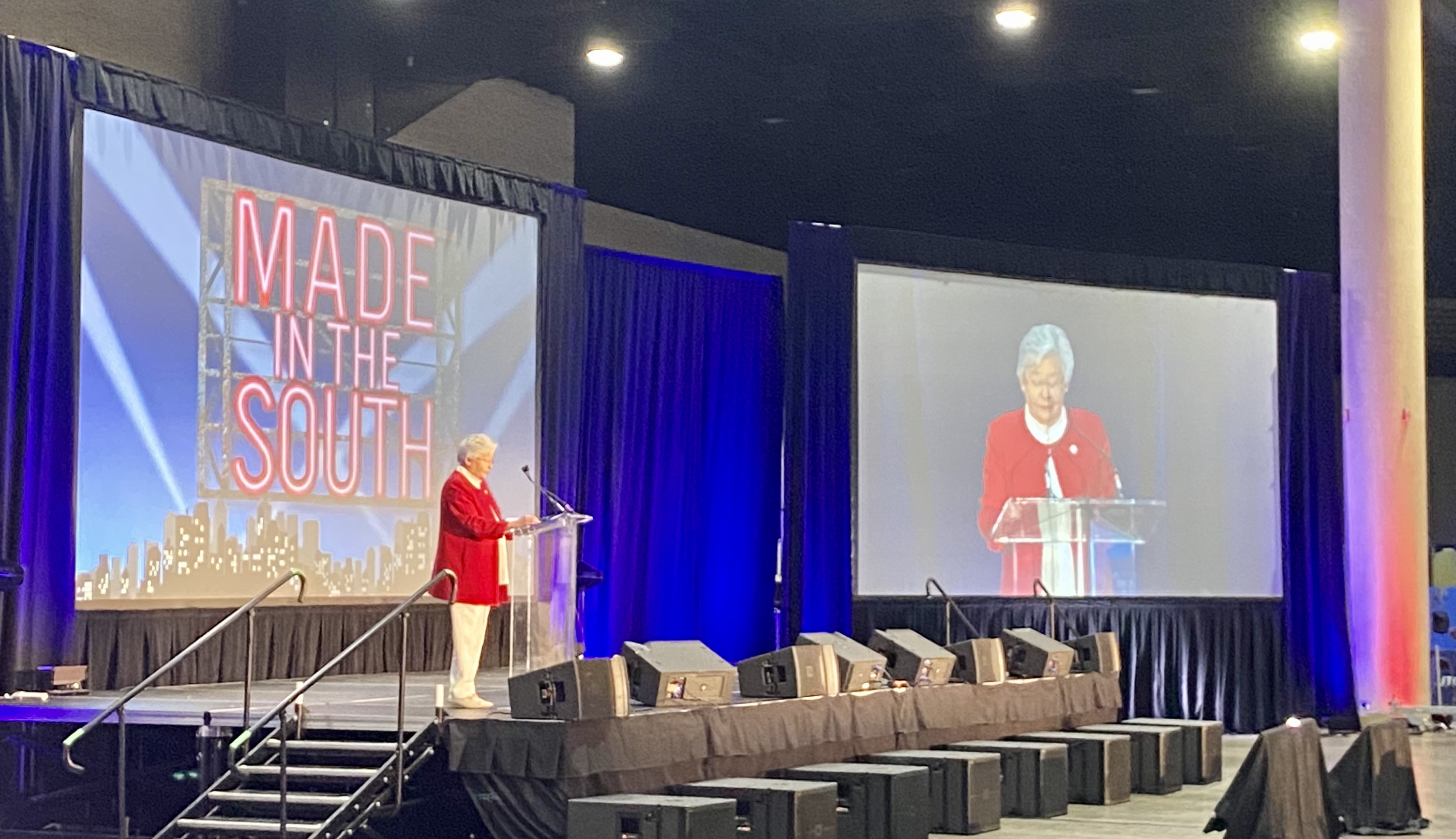

Attendance at the event was relatively high with about 1,200 attendees and 200 exhibitors. It was great seeing so many companies and representatives of the automotive industry getting together. A lot of Universities and Colleges, such as Georgia Tech, Alabama University, Athens State University, and the Ingram State College attended as well and brought in students and encouraged them to engage with the attendees and companies at the event. Furthermore, not only did Alabama’s Governor Kay Ivey kick-off the event, on Friday she was joined by Mississippi Governor Tate Reeves and South Carolina Governor Henry McMaster, to discuss the future of the automotive and manufacturing industry in the southern states of the U.S.

The conference was filled with a variety of speakers touching upon the most critical topics that have had and are still having a significant impact on the automotive industry. Although the break-out sessions and keynote speakers addressed different subjects, two of the main challenges that were addressed repeatedly were; the shortage of labor, especially the shortage of skilled labor, and the supply chain issues and constraints the automotive industry has been facing throughout the recent months.

The labor shortage has been a challenge for the automotive and manufacturing industries for decades. However, throughout the past 18 months, the COVID-19 pandemic intensified this shortage. Companies were forced to lay off workers, due to production being on hold. Employees also resigned on their own terms as there is still a wide-spread fear of retracting the COVID-19 virus. Now that for more companies production is up and running again and they are ready to hire, increased unemployment benefits, amongst others leave a lot of companies struggling to acquire new talent. Experts however also found that with the average age of manufacturing workers being around 44 – 50, a lot of laid-off workers decided to go into early retirement. Not only does this mean that internal knowledge transfer becomes more critical, but also that new, inexperienced hires require more training if no proper handover process is possible or in place.

Although it is expected that the labor shortage is going to decline towards the year as companies have been working on alternatives that make them less reliant and vulnerable to the volatilities of the labor market. Further, to relieve employees who are working, and have been working overtime over the past months to cover for the lack of labor. On one hand, there is a strong trend towards automation and automating processes. On the other hand, companies are tapping into new labor pools, working together with local schools, and creating programs to hire and train talent faster and maintain a steady pipeline of new employees.

Supply chain interruptions and material shortages have been an enormous challenge for the automotive and manufacturing industries. Due to supply chain interruptions a lot of OEMs and suppliers have ‘in-sourced’ production/ manufacturing, or at least moved it closer to the final assembly lines – primarily back to North and Central America. Which further adds to the labor shortage described above.

Raw material shortages for things such as lithium, plastic, steel, and last but not least chips have exacerbated the constraints OEMs face on the production side. While it seems difficult to predict when prices of raw materials will go down again, experts say that the chip shortage especially will continue at least through 2024. This is because the chip shortage has not only been caused by supply chain disruptions, but as the number of Electric Vehicles (EV) grows, the demand for chips will continue to grow as well. A conventional car needs about 300 chips, an EV however needs about 3,000 chips.

The labor market volatility and supply chain disruptions that the automotive and manufacturing industries are facing have however created an opportunity for many companies to rethink their value chain. Automated warehouse systems and automation, in general, have become more popular and necessary to ensure not only a more reliable supply chain but also to create a competitive advantage over other market players.

Recent Comments